UX/UI DESIGN, RESEARCH

Seamless digital banking experience for mobile and web.

I joined Celero as a UI/UX designer as one of 2 designers on the Xpress team. I supported the design across every aspect of the online banking product and was responsible for leading UX and UI across the application side of the platform.

Background

Xpress is a retail digital banking platform for Canadian credit unions. The solution includes public website, online banking, and mobile app capabilities for personal, retail, and small business clients.

Current credit unions that use Xpress online banking for their mobile apps and web platform include: Assiniboine Credit Union, Synergy Credit Union, connectFirst Credit Union, and more.

Problem Statement

Canadian credit unions need a better online banking platform for web and mobile that ensures a seamless client experience.

The process at Celero is a systematic approach with the goal of creating a intuitive user-centric experience for the credit union members. Here is the breakdown of the essential stages in the process:

Define

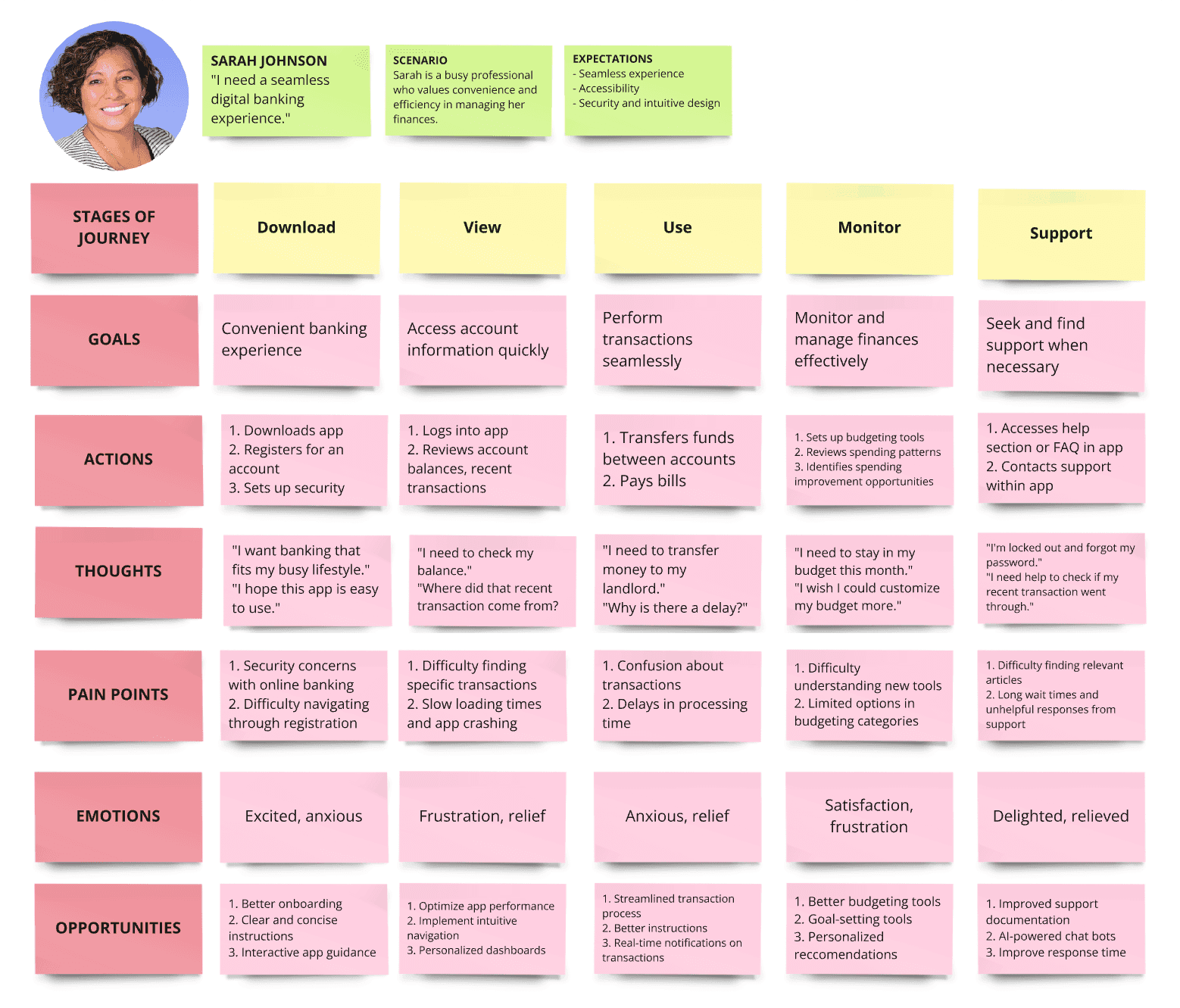

Journey Map

User Personas

Success Metrics

I conducted web conference interviews with key stakeholders, namely tech and support staff, as well as credit union management. End user interviews and open discussions were also held to understand how they would use Xpress digital platform on the web, or on mobile.

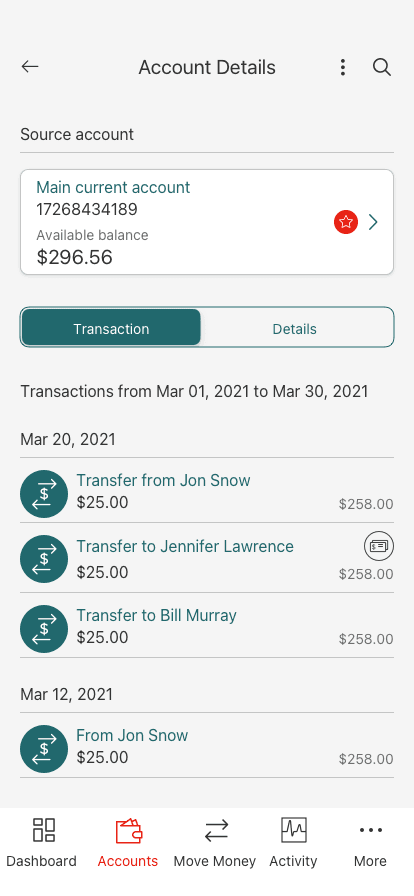

Competitive Analysis & Results

I researched their current banking platform (Member Direct), and interviewed the credit union team as well as business stakeholders about what pain points they were experiencing in their current workflow.

Member Direct: Usage Statistics

28% transactions were account transfers (80% between accounts)

46% were utility bill payments

21% were credit card payments

1.2% were international fund transfers

80% of users logged in only to check account balances

7.5% of utility bill payments were made via web

92.5% of utility bill payments were made via mobile app banking

User Pain Points

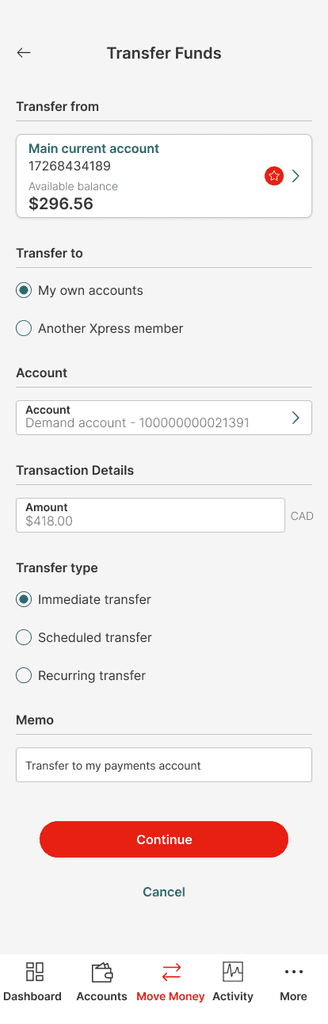

Too many steps for payment transfers and authentication

Complicated registration process

Too frequent app updates

Not enough features

Business Stakeholder Pain Points

Low web and mobile app usage

Difficulty adding new features and services due to old tech stack

Members still relying on in-person branch visit

With the results, we defined the problem, the users and their behaviors through ideation workshops with stakeholders, and presented them as user personas.

"I am a credit union member who wants to register for mobile banking, but the process is too complicated and frustrating."

"I am a small business owner. I want an easy way to e-transfer money to vendors for my business, but it won't let me verify the transaction."

Personas

User Journey

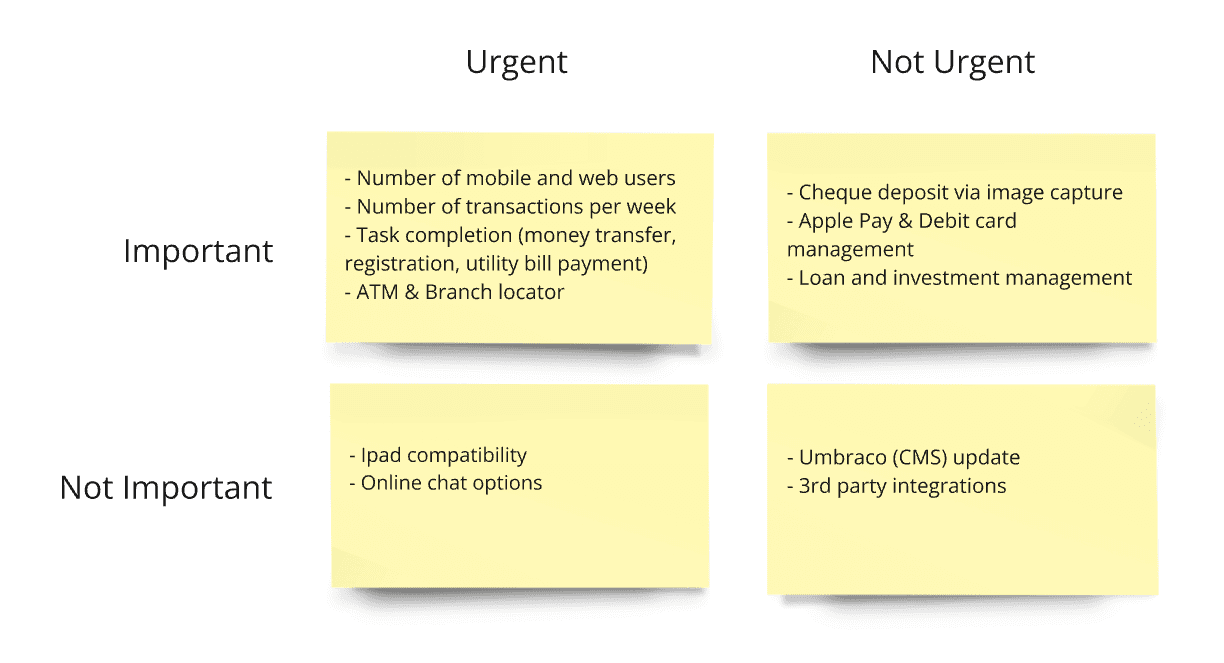

Working with the marketing and the product team, we identified the urgent and the non-urgent features that would define the success of the new banking experience to be included sooner, and what would be included at a later date.

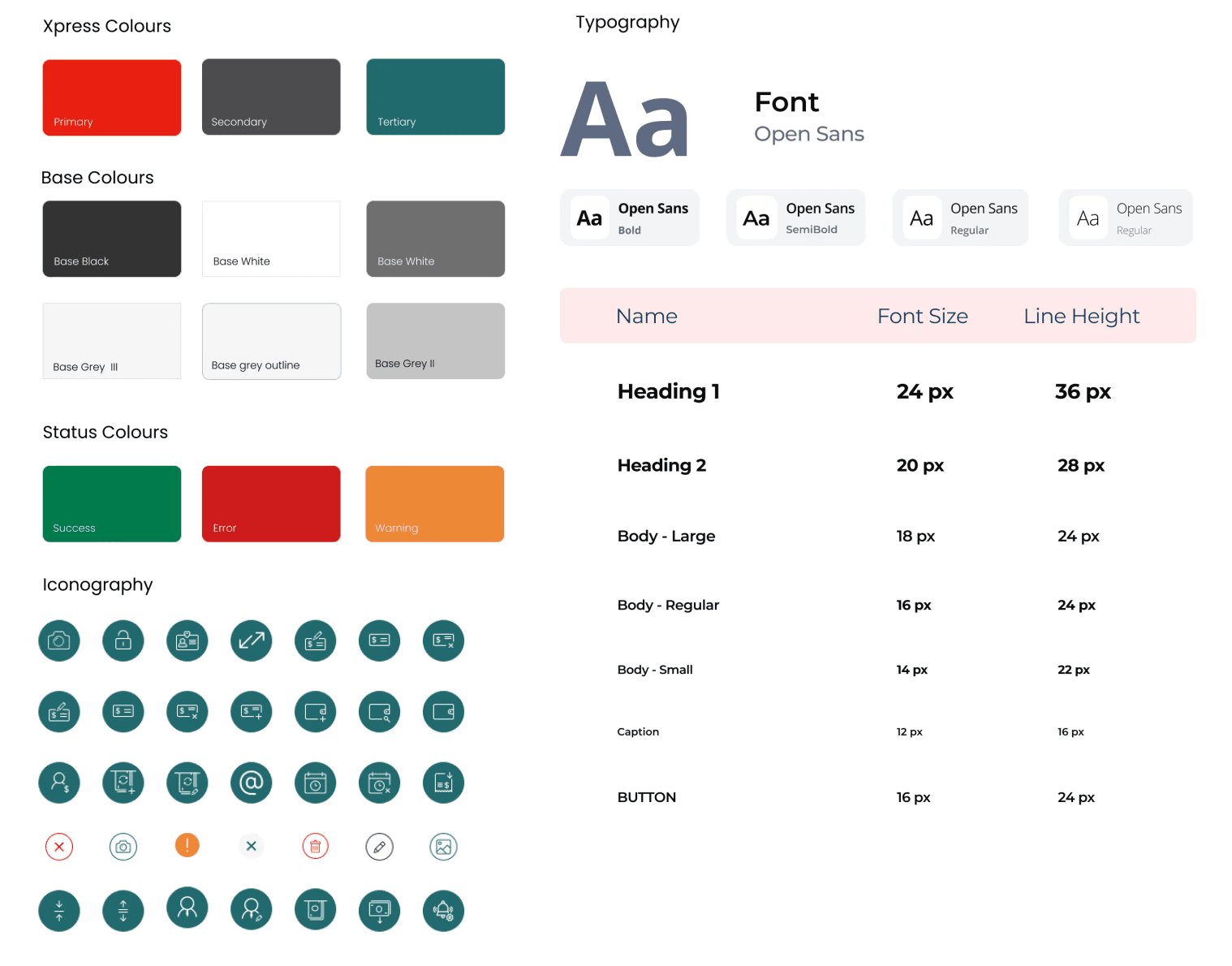

Once the ideation process was completed and features were locked down, we designed a style guide to ensure we adhered to branding and to better outline to credit unions how their own branding would apply to the product.

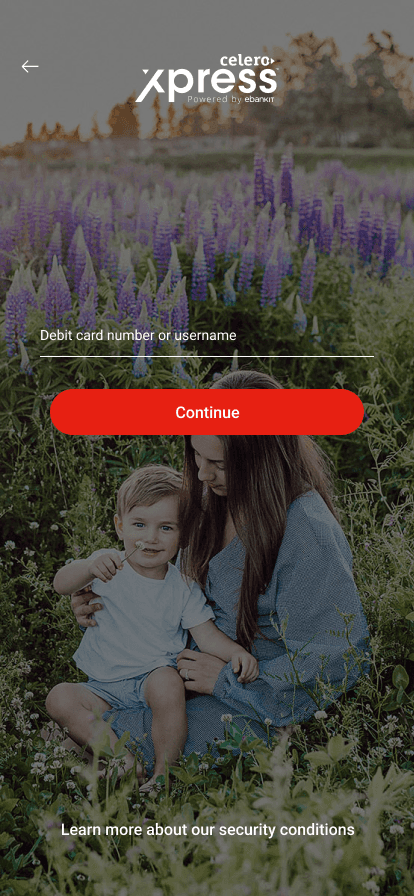

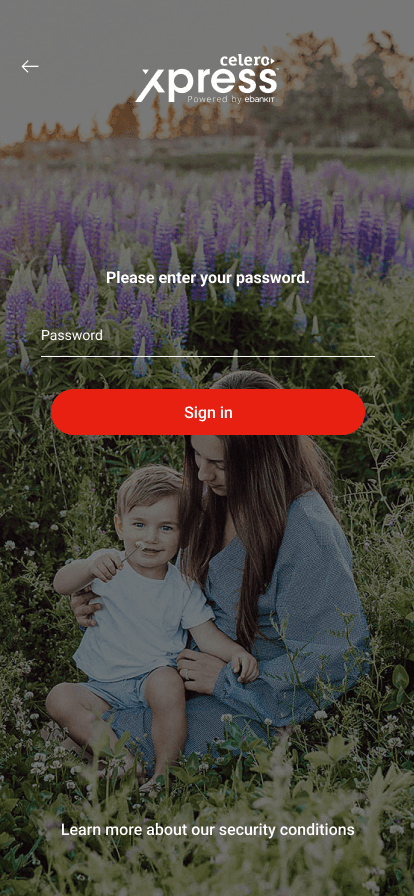

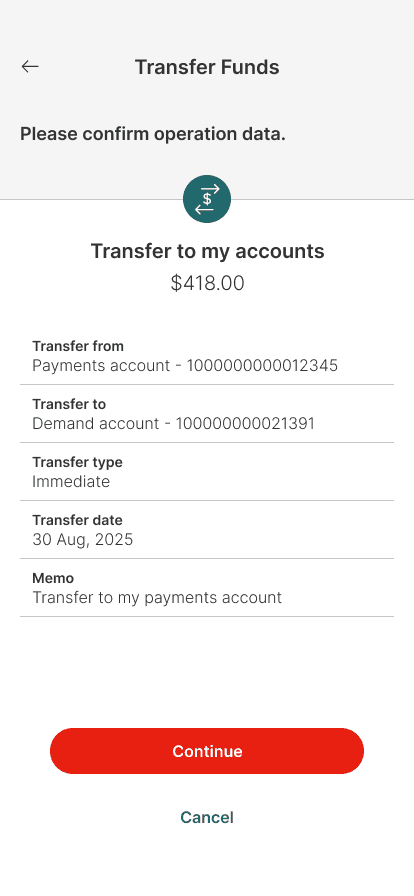

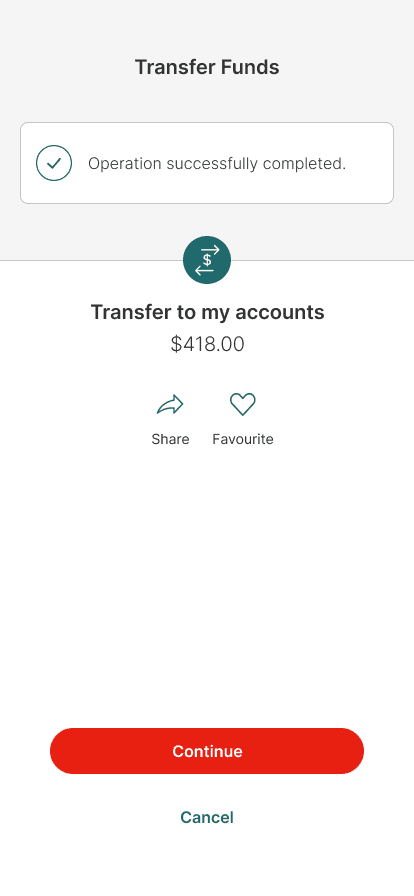

We created hi-fi web and mobile mockups of the final design solution that would include the key processes, such as signing in, transferring funds and paying bills, and viewing the home page dashboard.

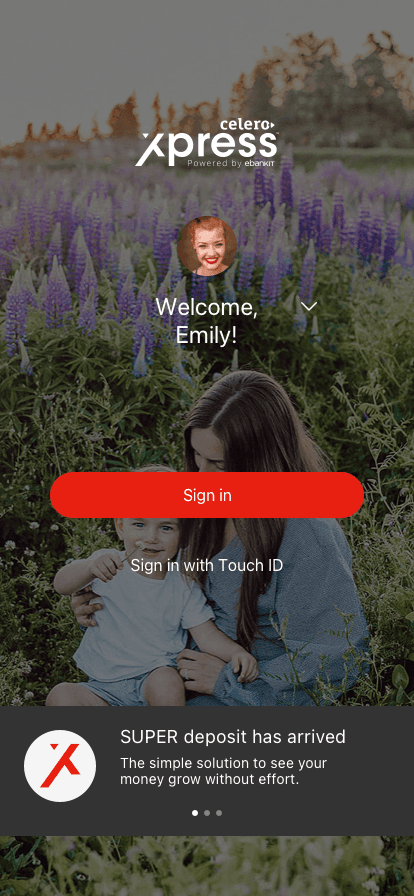

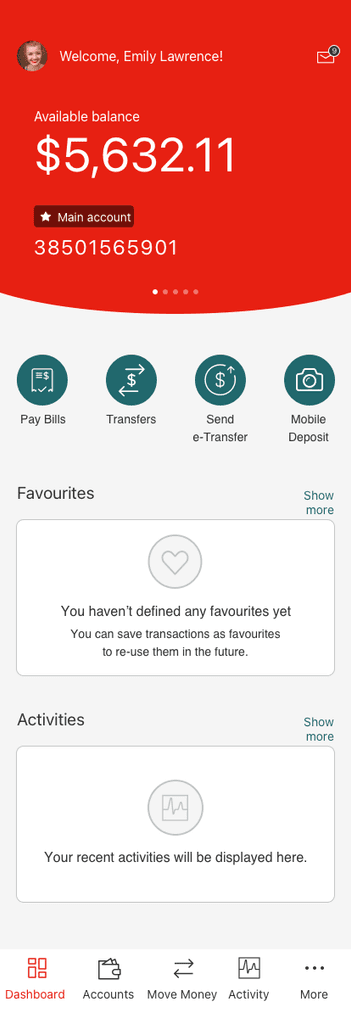

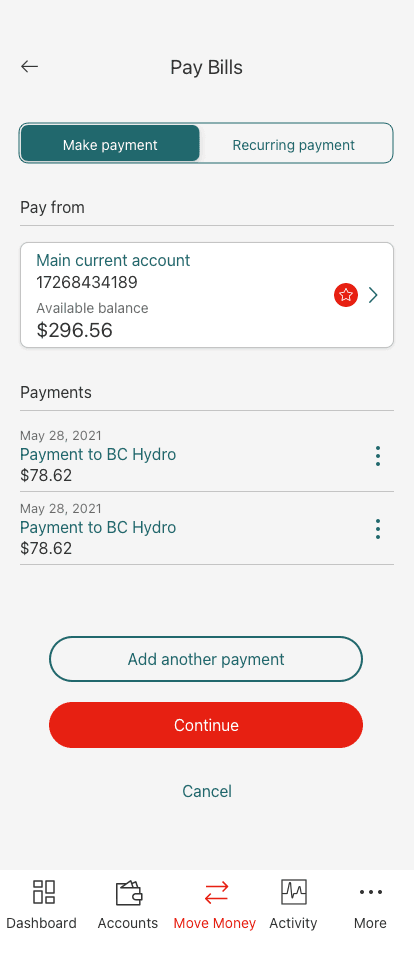

Mobile App Mockups

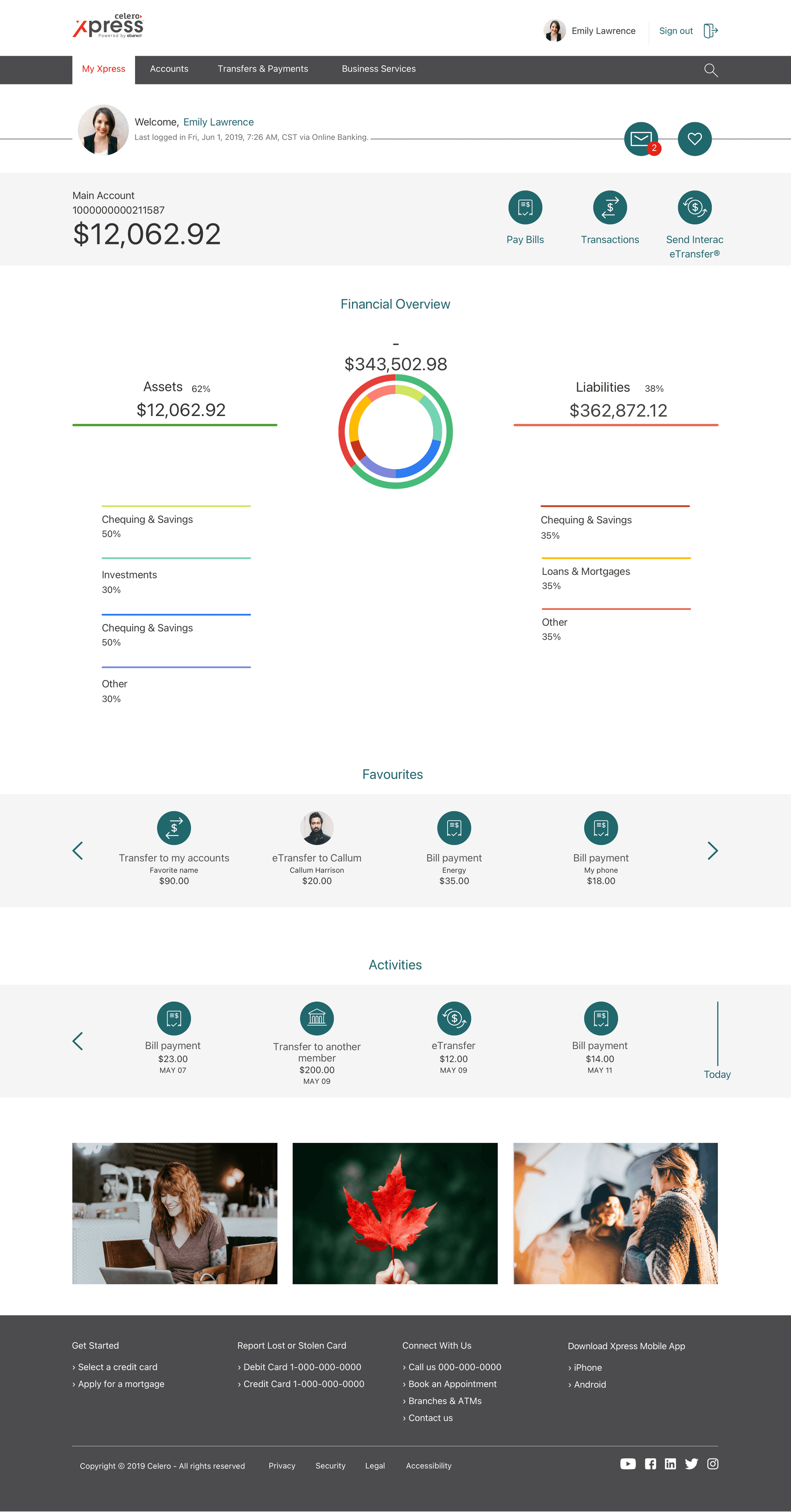

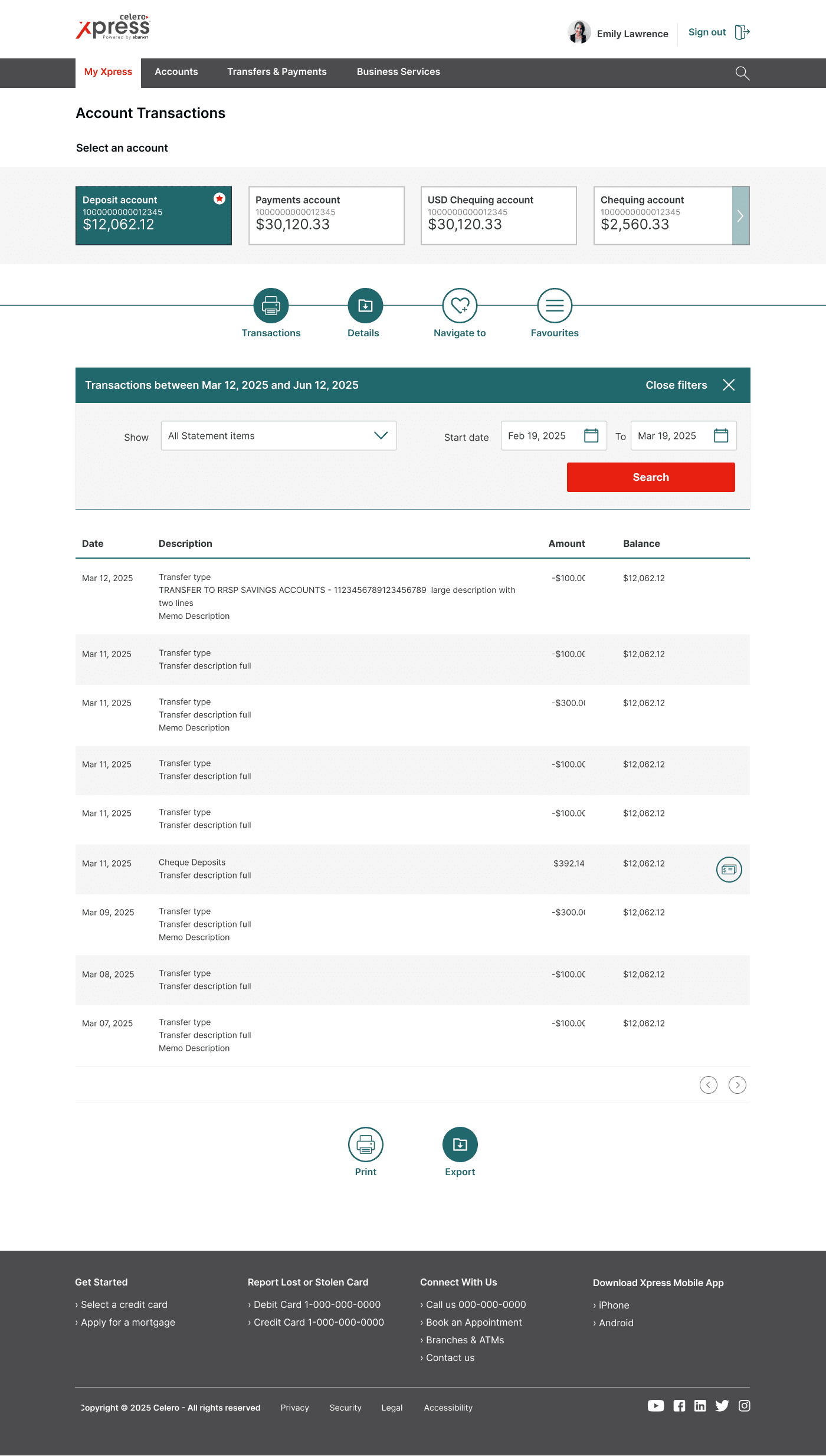

Web App Mockups

Outcomes and achievements of the project were measured during the usability testing phase, including user feedback, user reviews, transaction errors, and adoption rates.

We concluded the following insights:

Increased Efficiency

Stats reported 70% less errors rising from account related transactions, and 50% less task completion drop-offs.

Increased Usage

Number of transactions increased by 8%, and number of mobile/web app users increased by 10%.

Increased Satisfaction

Customer satisfaction score increased by 90%, as reflected in Google Play and Apple Store ratings as well as client surveys.

Reflection

Xpress is now used as the primary banking platform for 30+ credit unions across Canada. We implemented each credit union's branding onto the solution and worked with their marketing teams to ensure a seamless transition from their old platform to the new and improved one, offering additional branded features such as public website, web online banking, as well as Android and iOS mobile apps.

Implemented a design process and workflow. This has helped our team establish more structure to how we conduct our work and allow other teams to gain visibility across our upcoming sprints.

Establishing a branding guide. This has helped to maintain consistency in the look and feel across different parts of the platform.

Creating a design system. This helped collaborating teams understand how and why we choose to implement certain components over others.

This project is ongoing, subject to continuous improvement of the back-end as well as front-end features based on user feedback, analytics, and emerging technologies.

Our next steps on the Xpress product is continuing the conversion of the online web platform to meet accessibility guidelines, and using best design practices to ensure accessibility for all users.